Gold prices have hit a historic milestone, with retail rates crossing Rs 1 lakh per 10 grams in India. On Monday, June futures of gold on the Multi Commodity Exchange (MCX) surged to Rs 99,178 per 10 grams, while physical market rates stood at Rs 97,200 per 10 grams. With the addition of 3% GST, the effective retail price has now entered the six-digit zone—a first in the country’s market history.

This dramatic surge is being largely driven by heightened global uncertainties. Tensions between the US and China, fears of a renewed trade war, and friction between former US President Donald Trump and the Federal Reserve over interest rates have led investors to flock toward gold, traditionally considered a safe haven in times of crisis.

Experts say the rising international price of gold is playing a direct role in boosting domestic prices. In fact, gold prices have already jumped nearly 26% since the beginning of 2025, translating to a gain of over Rs 20,000 per 10 grams.

Despite the bullish trend, analysts advise retail buyers to tread with caution. “It’s not the time to rush into large purchases,” say market experts. Instead, buying in small phases could be a wiser strategy amid such volatility. Prices could see short-term corrections; especially as geopolitical and economic signals evolve.

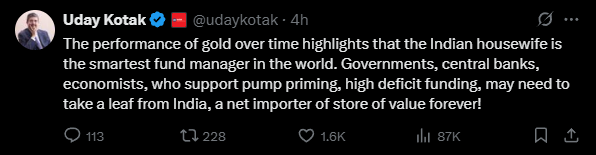

Interestingly, Indian housewives have been praised for their long-standing faith in gold. Uday Kotak, founder of Kotak Mahindra Bank, called them “the world’s smartest fund managers” in a recent post on X, noting that their traditional investments in gold have outperformed even the strategies of many global institutions.

As central banks continue their gold buying spree and global uncertainties persist, gold’s rally may still have room to grow. But for now, patience, prudence, and portioned buying seem to be the golden rules.